At this time our focus remains on our customers. In light of the current situation, we will be temporarily pausing new card applications.

The Woolworths Qantas Platinum Credit Card gives you the opportunity to earn Qantas points9 on your everyday spending, plus a whole range of platinum extras.

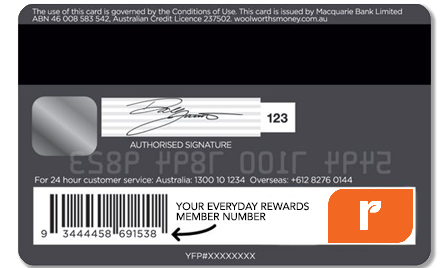

Plus, your credit card also doubles as your Everyday Rewards card, so you’ll have two great ways to earn points when you shop with us all with the convenience of one card.

All Woolworths credit cards are issued and administered by Macquarie Bank Limited ABN 46 008 583 542, Australian Credit License 237502. Woolworths receives a commission when your account is opened. Please see the Card Condition of Use for further details.

| Purchase Interest Rate | 20.49% p.a. |

| Cash Advance Interest Rate | 20.49% p.a. |

| Minimum Payment Due | 2.5% of the closing balance or $50, whichever is greater |

| Annual Primary Cardholder Fee First Year11 | $99 |

| Annual Primary Cardholder Fee Subsequent Years | $169 |

| Additional Cardholder Fee | $29 |

| Interest Free Period | Up to 55 days interest free on purchases only, which applies only if your Account is paid in full by the due date each month (excluding any balance transfers and Interest Free Finance balances that are in the specified promotional period) |

| Late Payment Fee | $20 per statement period if all amounts due are not paid by the payment due date |

| Dishonour Fee | $10 each time a payment to your account is dishonoured, debited to your account at the time of dishonour |

| Cash Advance Fee | $5 or 3% of the value of the transaction, whichever is the greater, applies to each cash advance made on your account, debited to your account at the time of the cash advance. |

| Voucher Request Fee | $8 per requested sales receipt provided by a third party, debited to your account at the time of the request (refunded if a dispute is resolved in your favour) |

| International Transaction Fee | 3% of the value of the transaction applies to each International Transaction, debited to your Account at the time the International Transaction is debited to your account |

| Over the Counter Transaction Fee | $0 (available in Woolworths stores) |

| Card Replacement Fee | $0 |

| Information Request Fee | $7 for each document of written information provided which includes each duplicate statement provided |

Use your Qantas Platinum Credit Card to make purchases everywhere Visa is accepted to earn Qantas points. You can then spend your Points on Qantas flights and other selected Qantas products and services.

Your Credit Card has your Everyday Rewards card printed on the back, so you'll never be at the checkout without it.

Find out more about Everyday Rewards and how you can collect and enjoy your Everyday Rewards points.

With a Woolworths Platinum Credit Card you also get access to some special perks, such as:

If your approved credit limit is less than $6,000, you will not be eligible for a Woolworths Qantas Platinum Card and will instead be issued with a Woolworths Everyday Card, which does not entitle you to Platinum benefits.

If you have a question or need some more information there are lots of ways to get in touch with us, or you can read our FAQs.

4. For full terms and conditions for the Visa Luxury Hotels Collections visit Visa luxury hotel benefits. Visa is responsible for all representations made regarding the offer and services.

5. 10% discount offer applies to existing primary and additional Woolworths Credit Card holders, with a registered Everyday Rewards card, the number of which is associated with and printed on the back of their Credit Card.

The Offer is available when making a purchase in-store at any Woolworths supermarket, or placing a groceries order online at woolworths.com.au (excluding items purchased from Everyday Market from Woolworths) from 12:01am (Sydney/Melbourne time) selected offer start date and 11:59pm (Sydney / Melbourne time) selected offer end date (“Offer Period”).

Dates are subject to change. Cardholders should check woolworths.com.au/credit-cards/10-off -your-shop prior to shopping.

The Offer cannot be bundled with, or used in conjunction with, any other offer (including employee discounts, if applicable). If you are entitled to a similar 10% discount offer with any of your other Woolworths Credit Card, Everyday Insurance and/or Woolworths Mobile products, you can use the discount offer once only in respect of all such products in any calendar month. Offer and is limited to one transaction per customer, up to a value of $500 of groceries in a single transaction (maximum $50 discount).

To be eligible for this offer, Woolworths Credit Cardholders must 1.Not be in breach of the Woolworths Credit Card Conditions of Use . 2.Ensure their Everyday Rewards Card is registered at woolworthsrewards.com.au/register_multi.html and 3. Associate their Everyday Rewards Card number with their Woolworths Credit Card by calling 1300 10 1234 (option 4) if this has not already been done.

It may take up to 45 days for the offer to be available after you have activated your Woolworths Credit Card.

The 10% off offer will only apply to one shop during the Offer Period. Eligible customers can choose one shop of their choice to apply the discount to during the Offer Period.

To receive the 10% off offer in-store, Credit Cardholders must scan their Everyday Rewards card number printed on the back of their Woolworths Credit Card during the Offer Period. Instore Customers will be alerted by an on screen prompt at self-serve or asked by a team member when going through a register if they wish to redeem the offer. Once the choice has been made to apply the discount, this decision cannot be reversed.

To receive the 10% discount for online groceries orders, Credit Card holders must place a groceries order online during the Offer Period, have their Everyday Rewards card number which is printed on the back of their Credit Card linked to their Woolworths Online account and enter the promo code (which can be found at woolworths.com.au/credit-cards/10-off ) at the online checkout at woolworths.com.au, and spend $30 or more on groceries for Pick up orders or $50 or more on groceries for Delivery orders.

Excludes any vouchers or offers or Delivery Unlimited items, bag fees and crate service fees, purchases of liquor, smoking/tobacco products and accessories, newspapers, Pre-order Kiosks and purchases on a charge account, Gift Cards (including iTunes), mobile recharge, Woolworths Mobile, travel cards and tickets, Carpet Care, lottery products and Everyday Market from Woolworths orders. Bag fees and crate service fees apply for Pick up and Delivery orders. This offer cannot be used with a Woolworths Online business account (i.e. an account with an ABN or Business Name). Woolworths reserves the right to cancel or amend this offer at any time without notice. Woolworths is responsible for all representations made regarding this offer. For online orders see woolworths.com.au for available delivery areas and full terms and conditions.

In addition to the above terms and conditions, by participating in the Everyday Rewards program, you agree to the Everyday Rewards T&Cs.

6. After the first year, the annual Woolworths Everyday Platinum Credit Card Primary Cardholder fee will be $49 and a $9 annual fee for each Additional Card.

7. Woolworths Credit Card Points are subject to the Woolworths Shopping Card Rewards Program Terms and Conditions. 3 Woolworths Credit Card points earned for every $1 spent on Woolworths brand range of products purchased in-store at Woolworths Supermarkets. 2 Woolworths Credit Card points earned for every $1 spent on products purchased in-store and/or online at Woolworths Supermarkets, Everyday Market from Woolworths and BIG W. 1 Credit Card point earned for every $1 spent on other eligible purchases. Woolworths Credit Card Points are not earned on cash advances, balance transfers or other restricted transactions detailed in the Woolworths Shopping Card Rewards Program Terms and Conditions. Every 4 months, Woolworths Credit Card points are automatically converted to a Woolworths Shopping Card redeemable at participating Woolworths Group stores. Participating stores may change from time to time. The Shopping Card is currently not accepted at DVD vending machines and mobile EFTPOS terminals. Minimum of 4,000 points is required to receive a $20 Shopping Card.

8. The 0% p.a. interest rate applies only to balances transferred with this offer for the first fourteen months from the date your account is approved and then reverts to the standard variable interest rate for cash advances, which is currently 19.99% p.a for the Everyday Platinum Card and 20.49% p.a for the Qantas Platinum Card. Interest rates are subject to change and Card Services credit criteria. Minimum repayments are required. For further details please click here.

9. Qantas Points are earned in accordance with and subject to the Woolworths Qantas Rewards Program Terms and Conditions. You will earn 1 Qantas Point per $1 spent in-store and/or online at Woolworths Supermarkets, Everyday Market from Woolworths and BIG W and 0.5 Qantas Points per $1 spent on all other eligible purchases. Qantas Points do not have any monetary value and are not transferable or redeemable for cash. Qantas Points are issued by Qantas Airways Limited. You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. Membership and the earning and redemption of Qantas Points are subject to the Qantas Frequent Flyer program terms and conditions. Further information on the Qantas Frequent Flyer program including the program terms and conditions are available at qantas.com/terms or by calling 13 11 31.Qantas Points are not earned on cash advances, balance transfers or other restricted transactions detailed in the Woolworths Qantas Rewards Program Terms and Conditions.

10. Overseas Travel Insurance, Interstate Flight Inconvenience Insurance, Transport Accident Insurance, Purchase Security Insurance, Extended Warranty Insurance and Global Hire Car Excess Waiver are underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) (Chubb) and are subject to the terms, conditions and exclusions contained in the Woolworths Money Qantas Platinum Credit Card policy of insurance between Macquarie Bank Limited (ABN 46 008 583 542 AFSL No. 237502) (MBL) and Chubb. This website doesn't take into account your objectives, financial situation or needs. It is important for you to read Woolworths Qantas Platinum Credit Card Insurance Terms and Conditions and consider the appropriateness of that insurance in relation to your individual requirements.

11. After the first year, the annual Woolworths Qantas Platinum Credit Card Primary Cardholder fee will be $169 and a $29 annual fee for each additional card. Annual fees are subject to change.

12. Available to Woolworths Platinum Credit Card holders only. Concierge Services are provided by Aspire Lifestyles (Australia) Pty Ltd. Accessing concierge services is free but you must pay for the goods or services that you purchase through the service.

13. Wallet Guard Insurance and Purchase Security Insurance are underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) (Chubb) and are subject to the terms, conditions and exclusions contained in the Woolworths Money Everyday Platinum Credit Card policy of insurance between Macquarie Bank Limited (ABN 46 008 583 542 AFSL No. 237502) (MBL) and Chubb. A limit applies of $2,500 per event. This website doesn't take into account your objectives, financial situations or needs. It is important for you to read Woolworths Everyday Platinum Credit Card Insurance Terms and Conditions and consider the appropriateness of that insurance in relation to your individual requirements.

14. Everyday Rewards is not available in Tasmania. For full terms and conditions visit everydayrewards.com.au/terms.

15. Applicable only if your account is paid in full by the due date shown each month (excluding any balance transfers and/or Interest Free Finance balances that are in the specified promotional period).

16. Visa’s Zero Liability policy covers Australian and New Zealand-issued cards and does not apply to ATM transactions, transactions not processed by Visa or certain commercial card transactions. Cardholders should notify their issuer promptly of any unauthorised Visa use. Please consult your issuer for additional details.

17. You will earn an additional Qantas Point per dollar spent on selected Qantas products and services in Australia, which are Qantas passenger flights (with a QF flight number) purchased directly from Qantas (i.e. where Qantas, and not its’ agent, is identified as the merchant on the credit card transaction) and Qantas Club and Qantas Frequent Flyer joining and annual fees. Purchases at Qantas Freight, Qantas Holidays, Qantas Business Travel, Jetset Travelworld channels, Qantas Staff Travel, the Jetstar Group of companies or goods or services supplied by Qantas Frequent Flyer Program partners are not eligible Qantas products and services and will not earn bonus Qantas Points. The bonus Qantas Points earned each month will be credited to your Qantas Frequent Flyer account within five business days of each Statement Period provided that you are not in breach of the Conditions of Use, your Account remains open and you have provided Card Services with a valid Qantas Frequent Flyer membership number.